Can Roof Replacement Be Part of the Solar Tax Credit?

Going solar is an excellent decision for homeowners looking to save money on their energy bills and reduce their carbon footprint. The good news is that the federal solar tax credit, also known as the Investment Tax Credit (ITC), can make this transition even more affordable. But what exactly does this tax credit cover? The short answer is that it includes the cost of solar equipment, labor, and energy storage devices – but not roof replacement or repair expenses, however, there’s a catch! In this article, I’ll discuss in detail the solar tax credit and provide clarity on what expenses qualify for the credit.

What are Included in Solar Tax Credit?

The federal solar tax credit, also known as the Investment Tax Credit (ITC), provides a valuable financial incentive for homeowners and businesses to go solar. This credit allows you to deduct a percentage of the cost of installing a solar energy system from your federal taxes.

The specific expenses that are eligible for the solar tax credit include:

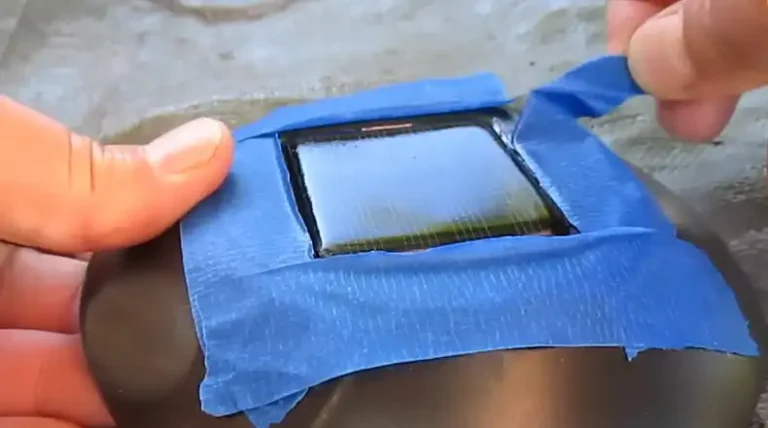

Solar PV Panels or PV Cells: The core components of a solar electricity system – the photovoltaic panels that convert sunlight into usable electricity – are fully covered by the tax credit.

Contractor Labor Costs: The ITC includes the labor costs for installing the solar equipment, such as the fees charged by the solar installation company.

Balance-of-System Equipment: This includes all the other necessary components beyond just the solar panels, such as the inverters that convert the electricity, the mounting hardware, and the electrical wiring.

Energy Storage Devices: For solar systems installed after December 31, 2022, energy storage devices like batteries with a capacity of at least 3 kilowatt-hours (kWh) are also eligible for the tax credit.

Sales Taxes: Any sales taxes paid on these qualifying solar-related expenses can also be included when claiming the ITC.

The key point is that the tax credit covers the full cost of the solar energy system – the equipment, the labor, and associated taxes. This makes going solar much more affordable for homeowners and businesses.

So Is Roof Replacement or Reroofing Covered by the Federal Solar Tax Credit (ITC)?

The short answer is no – the costs of replacing or repairing your roof are not eligible for the federal solar tax credit, even if that new roof is designed to accommodate solar panels.

The IRS instructions for claiming the ITC are very clear on this. They state,

| “No costs relating to a solar panel or other property installed as a roof (or portion thereof) will fail to qualify solely because the property constitutes a structural component of the structure on which it is installed.” (“2023 Instructions for Form 5695”) |

What this means is that the solar equipment itself can qualify for the credit, but the underlying roof work does not. Items like solar roofing tiles or solar shingles that serve dual purposes of both solar generation and roofing can be included. But standard roof replacement or repairs, such as replacing the decking or rafters, are considered purely structural and do not count toward the tax credit.

This is the case regardless of whether the home is your primary residence or a secondary property. The solar tax credit can be claimed on both, but the roof costs are excluded in either scenario.

What Happens if You Do Try to Include Roof Replacement Costs in The Solar Tax Credit?

Attempting to claim roof replacement or repair expenses as part of the solar tax credit is considered tax fraud. If the IRS were to audit your return and catch this, the consequences would be severe.

You would be required to pay back the entire amount of the improper tax credit, plus face significant fines and penalties. The IRS could also pursue criminal charges in serious cases of intentional tax evasion.

It’s simply not worth the risk. The solar tax credit is already a valuable incentive on its own, providing a 30% credit on eligible solar system costs. So there’s no need to try to inflate that further by including non-qualifying roof work.

The bottom line is that homeowners should only claim the actual solar equipment, labor, and storage costs when filing for the federal solar tax credit. Roof replacement should be budgeted and tracked separately. Maintaining clear documentation is crucial to avoid any issues with the IRS down the line.

Wrapping Up

The federal solar tax credit is a valuable incentive that covers the cost of solar equipment, labor, and energy storage devices. However, the expenses related to roof replacement or repair are not eligible for the credit. It’s important to understand the guidelines to ensure you’re maximizing your savings when going solar. If you have any additional questions or need further guidance, feel free to leave a comment below. We’re here to help you navigate the process and make the most of this fantastic solar incentive.