How To Claim the Federal Solar Tax Credit?

The Federal Solar Tax Credit, officially known as the Residential Clean Energy Credit, offers a significant financial incentive for homeowners considering solar energy. This credit allows you to deduct 30% of the cost of installing a solar energy system from your federal taxes. If you’re wondering how to claim this valuable benefit, you’ve come to the right place. This article will walk you through every step of the process, from determining your eligibility to filing the necessary forms.

Federal Solar Tax Credit Explained

The Residential Clean Energy Credit was introduced in 2005 to promote the adoption of renewable energy technologies. It’s been extended several times, most recently through the Inflation Reduction Act of 2022. This extension ensures that homeowners can benefit from the credit until December 31, 2034, making now an excellent time to consider solar energy for your home.

Currently, the credit stands at 30% of the total cost of your solar system installation. This percentage will remain in effect until 2032, after which it will decrease to 26% in 2033 and 22% in 2034. After 2034, the credit is set to expire unless Congress extends it further.

What Do You Need to be Eligible for Solar Tax Credit

Before diving into the claiming process, it’s crucial to understand if you qualify for the credit. The eligibility criteria are straightforward, but it’s essential to meet all of them:

- Installation Date: Your solar system must be installed between January 1, 2006, and December 31, 2034.

- Ownership: You must own the solar photovoltaic (PV) system. If you’re leasing the system or have a power purchase agreement (PPA), you’re not eligible for the credit.

- Location: The solar system should be installed at your primary residence or a second home in the United States. Some off-site community solar projects may also qualify if they offset your home’s electricity usage.

- Qualified Costs: The credit covers 30% of the total costs associated with the installation, including equipment, labor, and related expenses. However, it doesn’t include structural improvements solely to support the panels.

How to Calculate Your Solar Tax Credit

To understand the potential savings, let’s look at an example. Suppose your solar installation costs $20,000. The 30% credit would amount to $6,000, significantly reducing your overall investment. Here’s a simple table to illustrate potential savings at different installation costs:

| Installation Cost | 30% Tax Credit |

| $10,000 | $3,000 |

| $20,000 | $6,000 |

| $30,000 | $9,000 |

| $40,000 | $12,000 |

Remember, this is a tax credit, not a rebate. It reduces your tax liability dollar for dollar, but it’s not a cash refund. If your tax liability is less than the credit amount, you can carry forward the unused portion to future tax years, up until 2034.

How To Claim the Federal Solar Tax Credit: Step-by-Step

Now that you understand the basics, let’s walk through the process of claiming your credit:

1. Consult a Tax Professional

Before proceeding, it’s wise to seek advice from a tax professional. They can confirm your eligibility and help you understand how the credit will affect your overall tax situation.

2. Gather Necessary Documentation

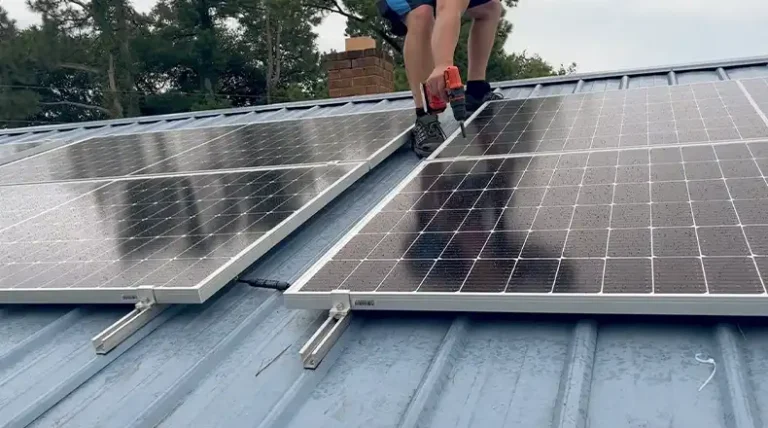

Collect all relevant paperwork related to your solar installation. This includes:

- Receipts and itemized invoices

- Manufacturer’s certification statement

- Permits and inspection documents

- Utility bills (before and after installation) to demonstrate the system’s impact

3. Obtain and Complete IRS Form 5695

This form is used to calculate and claim the credit. You can download it from the IRS website. Here’s how to fill it out:

- Part I: Enter your total qualified solar electric property costs on line 1.

- Lines 6a and 6b: Complete the calculations as instructed.

- Line 14: Use the Residential Energy Efficient Property Credit Limit Worksheet to determine any limitations based on your tax liability.

- Lines 15 and 16: Finalize your calculations.

4. Transfer Information to Your Tax Return

Take the amount from line 15 of Form 5695 and transfer it to Schedule 3 (Form 1040), line 5.

5. File Your Tax Return

Attach Form 5695 to your federal tax return (Form 1040 or Form 1040NR) for the year the solar system was installed. For instance, if your system was installed in 2024, you would claim the credit when filing your taxes in 2025.

When’s the Right Time to Claim Your Solar Tax Credit

The “placed in service” date is crucial for determining when you can claim the credit. This is typically when your system is fully installed and capable of generating electricity for your home. If your installation spans the end of a tax year, consult with your installer and tax professional to determine the correct year for claiming the credit.